There have been more than a dozen $100 million contracts since the Green Bay Packers made Brett Favre the charter member of that club in March 2001.

But virtually all of them are as flimsy as a house of cards and might as well make payouts in Monopoly money.

According to ESPN.com's Jamison Hensley, Pittsburgh Steelers quarterback Ben Roethlisberger last year became the first of the 16 players with a contract worth at least $100 million to earn as much as $70 million of that deal.

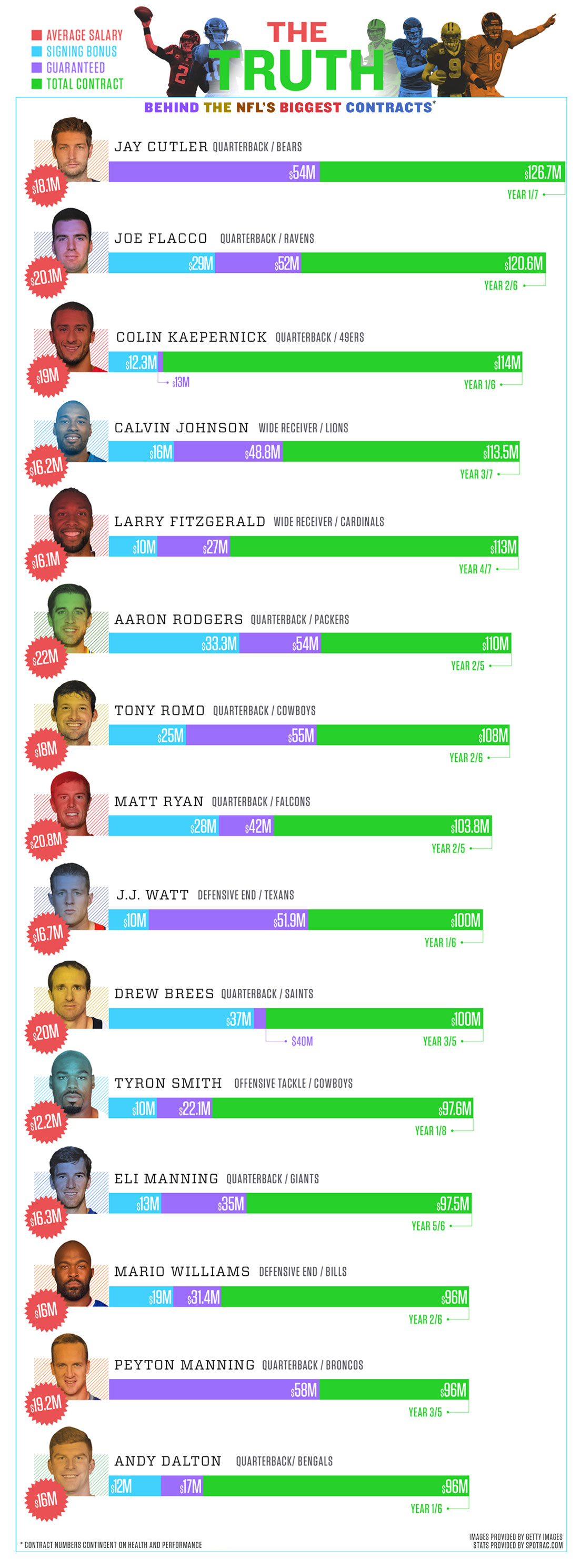

The $100 million club, though, appears to be legitimizing as the below infographic illustrates.

The NFL's First 100 Million Dollar Man

On March 1, 2001, Brett Favre signed a "lifetime" contract extension, a 10-year deal worth $100 million with the Green Bay Packers.

Before the popularity of social media, a player and his agent could bask in the glow of a

massive deal for a while because contracts took days to be fully processed. Drew Bledsoe signed the second $100 million contract, also in 2001.

“I’ve expressed over and over again my desire to play my entire career with the New England Patriots,” Bledsoe said at the time, according to The New York Times. “It looks like that is a very real possibility.”

Just two games into his 10-year contract, Bledsoe suffered a chest injury and was replaced by Tom Brady, who led the Patriots in 2001 to the first of three Super Bowl wins. Bledsoe was traded to the Buffalo Bills, and he ultimately made $15 million of the $103 million contract.

Initially, the massive contracts were a win-win for clubs and players.

Teams could lock star players into long-term contracts and spread out the signing bonus and other guaranteed monies over many years. Agents could use the headlines for the $100 million deal on websites and in newspapers to land more blue-chip clients.

"Agents wanted those big, fluff deals because it helped in recruiting,” former Chicago Bears general manager Jerry Angelo said. “But it was all perception."

Whereas contracts usually took several days to process, the full terms are now generally available within 24 hours. Players are also savvier about contracts, and clubs are less inclined to sign off on deals with too much funny money.

“Most teams got out of that business with

what they call ‘dummy years,’” Angelo said.

“Those dummy years potentially created

dead money, and it’s the money that’s on

your existing cap that keeps you from

going out into free agency and doing

anything.

“It was a case where you were borrowing

from Peter to pay Paul.”

During the 2012 offseason, after he was

hired as general manager of the Oakland

Raiders, Reggie McKenzie had to clean up

the salary-cap mess created by too many

imprudent contracts (think quarterback

JaMarcus Russell and defensive tackle

Tommy Kelly).

The Raiders' salary-cap number was $153

million—$30 million over the enforceable

maximum.

“Teams have come to this realization: You

can’t mortgage the future to guarantee the

present,” Angelo said.

Besides, one current team executive said,

“Fluff deals come back to bite you.”